Stanton Chase examines the ESG agenda, its origins, and its future. In this white paper, we will discuss examples of ESG implementation, evaluate current trends, anticipate future trends, and discuss the newly emerging role of Chief ESG Officers.

The notion of Corporate Social Responsibility (CSR) has been around for over half a century. In the past, CSR consisted mainly of companies investing capital in societal causes to improve their public image.

Still, CSR persisted as an important factor due to consumers’ growing loyalty to brands that aligned with their values. Consequently, companies began including social commitments alongside their annual reports.

Then Environmental, Social, and Governance (ESG) came along. It provided companies with measurable targets they could incorporate into their corporate strategies. ESG became a signpost to external partners and investors. Eventually, it also became a requirement for many public stock exchanges. It has provided companies with a methodology to assess the regulatory and reputational risks that arise from exposure to negative externalities.

ESG has become an increasingly important topic in the investment community. It encompasses a wide range of activities and aims to bring environmental and social concerns into corporate governance. It also considers financial factors. Although environmental sustainability and socially responsible strategies are not new, ESG has taken center stage on a global scale. This is particularly true among asset managers and environmentally conscious investors.

“ESG has become an increasingly important topic in the investment community. As a result, it is no longer considered a niche program.”

The vast majority of large corporations voluntarily report ESG data to their investors and stakeholders. There are now specific reporting frameworks for almost all industries.

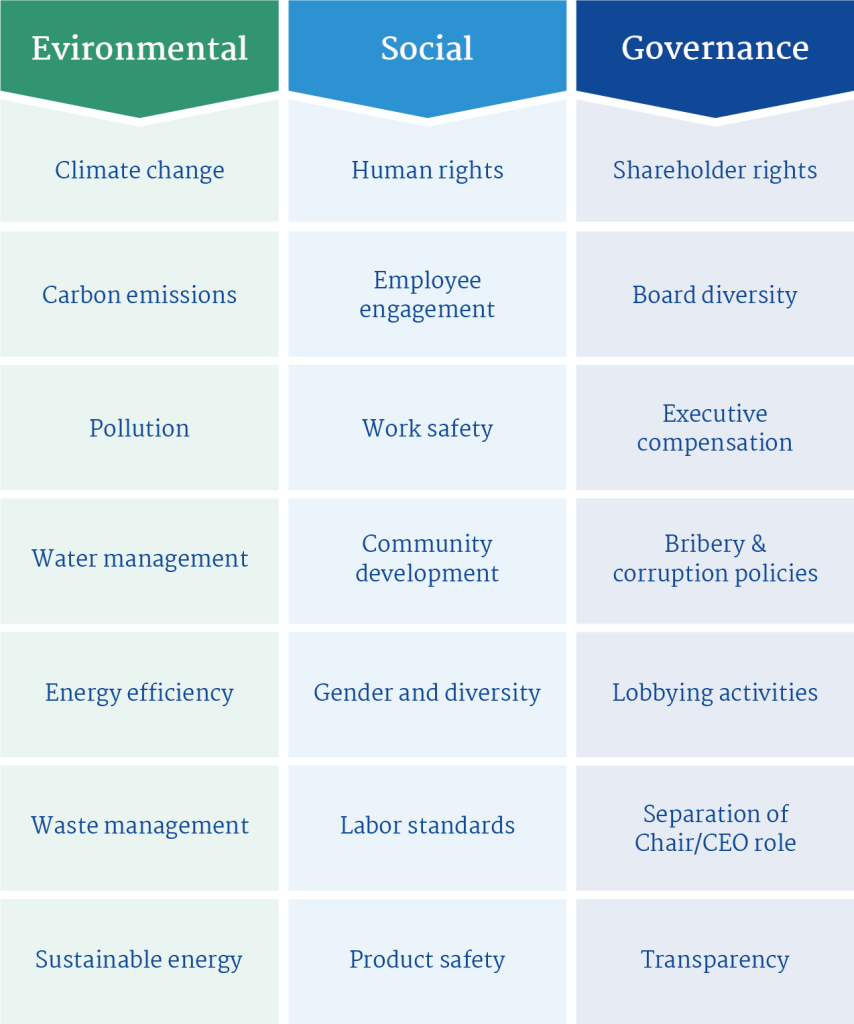

Some of the issues often considered to fall under ESG include:

It is important to note that ESG is not a measure of how “good” or “friendly” a company is. It is not necessarily a yardstick to measure the positive impact a company is having on the environment or the world. Far from a public relations exercise, the importance of the ESG agenda now acts to support the profitability of an organization.

For example, Elon Musk recently complained about Tesla’s removal from the S&P 500 ESG Index, despite Exxon Mobil placing in the top 10. This is because ESG reporting focuses on measuring the dollar value of risk/return, rather than climate impact alone.

As the environment, society, and governance are complex and interconnected, there is no definitive list of what ESG covers. Migration, food security, and climate change, for example, are all interrelated.

What is the Difference Between CSR and ESG?

In recent years, climate, environmental, and corporate governance issues have gained greater awareness. Consumers are increasingly considering these factors when making purchase and investment decisions. Stakeholders are no longer satisfied with one-dimensional corporate responsibility. They want and expect more. Thus, greater responsibility, transparency, and sustainability of programs, along with quantifiable reportable actions, became the crucial differences between CSR and ESG.

“Stakeholders are no longer satisfied with one-dimensional corporate responsibility. They want and expect more.”

Howard Bowen championed CSR in 1953, but the term didn’t catch on until the 1970s. Instead of viewing businesses solely as market-driven entities of profit and loss, the concept emphasizes businesses’ social, environmental, and community responsibilities. Corporate social responsibility acknowledges and implements philanthropy and ethics.

CSR is self-regulated. Companies are free to decide the how, where, and what without being subject to any external guidelines or standards. A real emphasis is not placed on making CSR programs quantifiable and comparable across industries, countries, or borders. Additionally, CSR places a lesser emphasis on corporate governance than ESG.

There have historically been few metrics associated with CSR and it normally does not form part of any core business strategies. In contrast, ESG is often incorporated into core business strategies and is measurable. For example, a tree plantation drive carried out by CSR would involve employees spending a day planting trees. The same drive conducted through an ESG program would set a target of planting a particular number of trees in a specified period.

Different jurisdictions also regulate ESG differently. CSR, however, is not regulated. The US ESG Disclosure Simplification Act and the EU Sustainable Financial Disclosure Regulation both regulate ESG in their jurisdictions.

Why It Is Crucial to Build an ESG-Based Culture at Your Company

We now have the ESG agenda at the core of businesses. Fundamentally, this involves minimizing short-term profit-seeking drives that negatively impact the environment.

Companies that emphasize sustainability have higher staff morale, low turnover rates, and reduced waste. Consumers and investors also value companies that align their resources and productivity in a way that improves their sustainability and contribution to the community.

Studies by Morgan Stanley and PwC suggest strong market demand for ESG indicators. A study by Morgan Stanley suggests that 35% of consumers are ready to pay 25% more for sustainable products. The same study indicates investors are also becoming overwhelmingly sensitive to ESG-related issues. Ninety-five percent of investors polled showed a desire to implement ESG in their portfolios. Research by PwC suggests that 76% of buyers are willing to stop buying the products of companies that are unsustainable, mistreat their workers, or harm their communities. The study indicates employees themselves are more interested in working for companies that care about the same issues as themselves.

Reports indicate ESG assets will surpass $53 trillion by 2025. Overall, the data suggests ESG is here to stay and will continue to grow in importance. In fact, ESG funds have been outperforming the S&P 500 by 27%-57% since COVID-19.

When corporate strategies include ESG in a meaningful way, it can intensify the impact of branding, marketing, public relations, and more. In other words, ESG isn’t a deadweight expense. It can increase growth and profitability.

What Are Some of the Other Benefits of ESG?

There is no doubt that ESG creates long-term value for companies. In fact, it contributes to improved financial performance. This may be the most statistically significant factor that connects higher shareholder value with increased sustainability. Other benefits include improved management, reduced uncertainty and risk, and improved capital policy. A better relationship with stakeholders also improves the value of intangible assets.

ESG goes beyond shareholder value in the following ways:

The Four Phases for Implementing Your Own ESG Program

Implementing an ESG program in your organization will require a four part strategy.

- The first phase

Evaluate the company’s readiness, set targets, and identify key performance indicators that meet the needs of external and internal stakeholders. This is the phase when the company must identify risks, gaps, and goals associated with implementing and managing the program.

- The second phase

Create a governance structure to oversee the implementation process. It is important to establish a cross-departmental ESG committee to keep track of progress and report to the board. Ideally, the Board of Directors should oversee this process. As the program matures, the structure is likely to need revision and revisiting.

- The third phase

Gather data, both internal and external, about ESG factors. The next step may involve educating internal stakeholders on how to obtain the data or consulting with advisory firms such as Institutional Shareholder Service or Glass Lewis & Co., both of which collect and disseminate the relevant data. The goal is to implement protocols that automate data collection in an auditable, repeatable, and reportable manner. Additionally, the company will have to decide what data to disclose.

- The fourth phase

Communicate your progress with internal and external stakeholders by comparing your latest data to the KPIs you set in step one. Many companies have a dedicated ESG webpage on their website that contains PDF versions of their progress reports.

How Will ESG Develop in the Future?

In 2021, ESG-dedicated funds increased by $500 billion, representing a 55% growth year-on-year, driven by small and large investors alike. It’s not difficult to understand why.

Governments are creating policies and regulations that encourage or compel ESG implementation. It’s a good thing, too. Businesses need to adapt to the changing world in order to remain competitive.

Although ESG may have been inspired by investors in publicly traded companies, it has since expanded to include public and private companies, financial institutions, index providers, rating agencies, and consulting firms. ESG implementation is a mutually reinforcing process in which rating agencies and indexes increase the number of companies that adopt ESG practices. By hiring ESG consultants and seeking financing from banks that provide financing for ESG initiatives, companies create an ESG ecosystem and increased value chain.

“In light of the growing demand, political support, and maturity of ESG implementation, it is clear that ESG is here to stay and will remain an important aspect of business for the foreseeable future.”

In light of the growing demand, political support, and maturity of ESG implementation, it is clear that ESG is here to stay and will remain an important aspect of business for the foreseeable future. The real challenge for companies is to implement ESG in a meaningful way that helps them improve their market position, profitability, brand image, and social impact while integrating their company into the fabric of their communities.

What Does the Age of ESG 3.0 Mean for You?

ESG will continue to play an increasingly important role in our corporate landscape, but that does not mean it will remain static. We are currently in the era of ESG 3.0. Prior phases, ESG 1.0 and ESG 2.0, were characterized by exclusions in defense of sustainability and the environment, digitalization of benchmarking, and mainstreaming of ESG concepts. In ESG 3.0, however, you are required to put your money where your mouth is.

What makes stakeholders insist on serious monetary investment in ESG? The answer is that greenwashing has disillusioned and disappointed many. Earlier this year, two large European banks’ offices were raided as part of an investigation into allegations of greenwashing, which involved misleading investors about ESG issues. In the wake of Morningstar culling approximately 1,200 of its ‘sustainable’ funds, the SEC has proposed new rules to curb greenwashing too. There is a growing consensus that many companies’ ESG methodologies are flawed, leading to the misallocation of resources intended to combat issues like climate change.

The answer? Instead of simply offsetting the unintended damage companies can do to the environment and communities, companies need to invest in change. This investment must be tangible, well-managed, and properly reported. There will no longer be any tolerance for misinformation about ESG initiatives and progress among investors, index providers, and regulators. Inaccurate ESG reports will have real consequences for companies.

Do You Need a Chief ESG Officer?

A shift is occurring in ESG and the expectations related to it. The C-suite is constantly evolving too. In the face of a push for more impactful ESG practices, you might need a Chief ESG Officer (CESGO) on your side. Many companies, including Verizon, C.H. Robinson, and Royal Caribbean, have recently appointed one.

Your CESGO’s duties and responsibilities will depend on your company and its functions. At its core, this role assures that someone is responsible for ensuring the company abides by environmentally friendly practices, that it strives to improve sustainability, and that it interfaces with the community that it belongs to as well as the regulatory bodies that oversee it.

A Chief ESG Officer’s role also includes transforming the company into a more ESG-conscious organization. Consequently, CESGOs need to go further than just reporting on ESG issues. As part of their role, they should promote board-level discussions about operational, functional, staffing, and asset changes through an ESG framework.

The following questions should guide your decision about creating a CESGO role at your company:

- Is a CESGO a good fit for your current executive team?

It is vital to consider whether any of your current executives have absorbed ESG responsibilities in their roles. If they have, you will need to consider the effect of transferring them to a new executive. Additionally, if another executive has taken on ESG responsibilities, you should evaluate whether their performance in this regard has been satisfactory. You will also need to consider whether they have the qualifications and experience to effect change. The World Economic Forum identified 21 core and 34 expanded metrics for measuring a firm’s impact. Therefore, even an adjacent executive like a Chief Sustainability Officer or Chief Diversity Officer may find it challenging to manage all relevant metrics.

- How important is ESG to your stakeholders?

Shareholders aren’t the only stakeholders you have. You should consider your employees’ and executives’ engagement in your ESG initiatives too. If they aren’t committed, you won’t be able to improve your ESG impact even with a CESGO on board. Younger generations are pushing for a greater focus on ESG. According to Nielsen, 83% of millennials care about whether the companies they support have effective ESG programs. It will become increasingly imperative to cater to millennials and Gen Z as their buying power increases.

- Is ESG an important part of your business?

As you know, ESG is important, but its importance may vary based on the functions of your business. For example, ESG will be more important to a company that manufactures and distributes eco-friendly soap than to one that doesn’t market its products under a green label. Your company may want to invest in a CESGO if part of its pitch is that it is eco-friendly, sustainable, or community-oriented.

How to Find Your Next ESG Executive

The notion that executive remuneration should be linked to ESG performance is gaining traction. As a result, many boards are scrambling to find the right people to advance their ESG initiatives.

The good news is that ESG officers are becoming easier to find. According to LinkedIn’s Global Green Skills Report 2022, the number of people with the skills and knowledge needed for ESG projects is growing exponentially. However, there’s bad news too. It can still be extremely difficult to find someone with ESG skills who is capable of driving your ESG initiatives forward, ensuring proper reporting, and engaging your entire company’s culture. The ability to drive measurable change is more important than having the knowledge on paper. ESG officers and executives need to be able to apply their know-how in the real world.

“It can still be extremely difficult to find someone with ESG skills who is capable of driving your ESG initiatives forward, ensuring proper reporting, and engaging your entire company’s culture.”

Organizations looking to hire ESG executives should consider the following:

- What it takes to be a successful ESG executive. Executive ESG candidates must be capable of developing and implementing ESG strategies aligned with the company’s goals, understanding how ESG indicators can be used to measure progress, and effectively communicating the benefits of ESG to stakeholders. In order to be considered for the position, candidates should demonstrate a track record of successfully implementing, reporting, and engaging the public about ESG issues. Candidates with backgrounds in environmental science and communications should be given extra consideration.

- ESG and DEI should go hand in hand. When looking for an ESG executive, ask yourself what they can do to help you advance your DEI initiatives. It can be difficult for investors to assess the social aspects of ESG issues (such as DEI). Likewise, companies often struggle to demonstrate tangible progress on social ESG issues. It is not enough for candidates to be proficient in sustainability and environmental issues; they must also be able to manage DEI initiatives within their ESG projects (and use effective metrics to monitor progress).

- The scarcity of highly adept candidates impacts the compensation of ESG executives. It is becoming easier to acquire ESG skills, but those with the track record you are looking for remain hard to find. In addition to their scarcity, other companies are hiring them as well. Consequently, compensation is a tricky topic when hiring an ESG executive. The package you are offering to ESG executive candidates must be market-related or you will lose them to your competitors.

If you’ve realized that you’re missing ESG skills in your organization or need a Chief ESG Officer, finding the right person may seem impossible. The process of identifying potential candidates, determining what to look for, and deciding what to offer can be stressful and difficult. As an expert in ESG executive recruitment, Stanton Chase has helped numerous international companies find top ESG leaders. If you want to change your company, and perhaps even the world, our global team of consultants can assist you in finding the right ESG executive.

About the Author

Fernando Rodriguez is a Senior Partner at Stanton Chase Santiago. He is also the LATAM Regional Practice Leader for ESG.

Heidi Tieslau is a Director at Stanton Chase Nashville. She is also the North American Regional Practice Leader for ESG.

How Can We Help?

At Stanton Chase, we're more than just an executive search and leadership consulting firm. We're your partner in leadership.

Our approach is different. We believe in customized and personal executive search, executive assessment, board services, succession planning, and leadership onboarding support.

We believe in your potential to achieve greatness and we'll do everything we can to help you get there.

View All Services